T.Y B.COM

SEMESTER - 5

ADVANCED ACCOUNTING

UNIT - 1

CHAPTER - 1

ACCOUNTING FOR AMALGAMATIONS

Amalgamation:

The term amalgamation is used when two or more existing companies go in to liquidation and a new company is formed to take over their business. The term absorption is used when one or more existing companies go into liquidation & one existing company takes over or purchases their businesses. However this difference between amalgamation & absorption has been dispensed with the Accounting Standard (AS-14) ‘Accounting for Amalgamations’ issued by ICAI. Thus amalgamation means merging of one company with another company or merging of two or more companies to form a new company or one company is taken over by the other. Hence amalgamation includes absorption. In amalgamation the assets & liabilities of transferor company(ies) are amalgamated with the transferee company.

AS-14 specifies the procedure of accounting for amalgamations and the treatment of any resultant goodwill or reserves. The following terms are used in this standard with reference to amalgamation of companies.

a) Amalgamation : means an amalgamation pursuant to the provisions of Companies Act, 1956 or any other statute, which may be applicable to companies.

b) Transferor : Company means the company which is amalgamated in to another co.

c) Transferee : Company means the company into which Transferor Company is amalgamated.

d) Reserve : Means the portion of earnings, receipts or other surplus of an enterprise (Whether (C) Capital or (R) Revenue) appropriated by the management for a general or a specific purpose other than a provision for depreciation or diminution in value of assets or for known liability.

Types of Amalgamation:

Amalgamation for accounting purpose can be classified into two categories.

1. Amalgamation in the nature of merger

2. Amalgamation in the nature of purchase.

Amalgamation in the nature of Merger:

This is a type of amalgamation which satisfies all the following conditions.

1. All the liabilities and assets of the transferor company become after amalgamation, The liabilities and assets of the transferee Company.

2. Shareholders holding not less than 90% of the face value of the equity shares of the transferor company become equity shareholders of transferee company by virtue of the amalgamation.

3. The consideration for the amalgamation receivable by those equity shareholders of transferor company who agree to become equity shareholders of the transferee company is discharged by the transferee company wholly by issue of equity shares in transferee company except that cash may be paid for in respect of any fractional shares.

4. The business of the transferor company is intended to be carried on by the transferee Company

5. No adjustment is intended to be made to the book value of the assets and liabilities of Transferor Company when they are incorporated in the accounts of Transferee Company, except to ensure that the accounting policies are uniform.

Amalgamation in the nature of Purchase:

Amalgamation may be considered in the nature of purchase when any one or more of the five conditions specified for amalgamation in the nature of merger is not satisfied. These amalgamations which are in effect a mode by which one company acquires another company & hence the equity shareholders of the combining entities do not continue to have a proportionate share in the equity of the combined entity or the business of the acquired company is not intended to be continued after amalgamation.

Purchase Consideration:

According to AS-14, purchase consideration for the amalgamations means the aggregate of the shares & securities issued and the payment made in the form of cash or other assets by the transferee company to the shareholders of the transferor company. Purchase consideration does not include the amount of liabilities taken over by the transferee company or the amount paid directly to the creditors of the transferee company.

There are differented methods in which consideration may be calculated :

1. Lump Sum method :

This is the simplest method. The amount to be paid by Transferee Company as purchase consideration may be stated in the problem as lump sum. In such case no calculation is required. For example it may be stated that A Ltd. takes over the business of B Ltd. for Rs. 25,00,000. Hence the sum of Rs. 25,00,000 is purchase consideration.

2. Net Payment Method :

Under this method, the purchase consideration is ascertained adding up the total payments made by transferee in whatever form either in shares, debentures or in cash to the liquidator of the transferor company for payment to equity shareholders and preference shareholders of the transferor company. While ascertaining the purchase consideration, care should be taken of the following:

a) The value of assets and liabilities taken over by the transferee company are not to be considered.

b) The payments made by the transferee company for shareholders whether in cash or in shares or in debentures must be taken into account.

c) Where the liabilities are taken over by the transferee company & subsequently discharged such amount should not be added to purchase consideration.

d) When liabilities are taken over by transferee company they are neither deducted nor added to the amount arrived at as purchase consideration.

e) Any payments made by transferee company to some other party on behalf of the transferor company are to be ignored.

f) If the liquidation expenses of the transferor company are paid by the transferee company the same

should not be taken as a part of the purchase consideration.

g) If any liability is not taken over by the transferee the same should be excluded.

h) The term business will always mean both the Assets and Liabilities of the company.

3. Net Assets Method :

Normally the net payment method is used to compute the purchase consideration. However, it cannot be used if details of all payments are not available e.g. in case where the purchasing company agrees to pay, say by way of 1,000 shares and the balance in cash, the purchase consideration is determined by adding up the ‘agreed values of all assets taken over’ and deducting the ‘agreed value of all liabilities taken over’. While determining the amount of purchase consideration under this method, care should be taken of the following:

a) The term ‘Assets’ will always include cash in hand and cash at bank, unless otherwise stated but shall not include any fictitious assets like preliminary expenses, underwriting commission, discount on issue of shares or debentures, profit and loss account (debit balance), etc.

b) Asset not taken over by Transferee company should be excluded.

c) If there is goodwill or prepaid expenses, the same should be included in the assets taken over unless otherwise stated.

d) The term ‘liabilities’ will mean all liabilities to third parties.

e) The term ‘trade liabilities’ will mean trade creditors and bills payable.

f) The term ‘liabilities’ shall not include any past accumulated profits and reserves such as general reserve, reserve fund, sinking fund, dividend equalization fund, capital reserve, share premium account, capital redemption reserve account, profit and loss account etc. These are payable to the shareholders and notto the third parties.

g) If any fund or portion of any fund denotes liability to third parties the same must be included in Liabilities such as staff provident fund, workmen’s savings bank account, workmen’s profit sharing fund, workmen’s compensation fund (up to the amount of claim if any), etc.

h) If any liability is not taken over by the transferee the same should be excluded.

i) The term businesses will always means both the Assets and Liabilities of the Company.

4. Intrinsic worth/ Share Exchange Method :

In this method, purchase consideration is ascertained on the basis of the ratio in which the shares of the transferee company are to be exchanged for the shares of the transferor company. The exchange ratio is generally determined on the basis of the intrinsic value of each company shares.

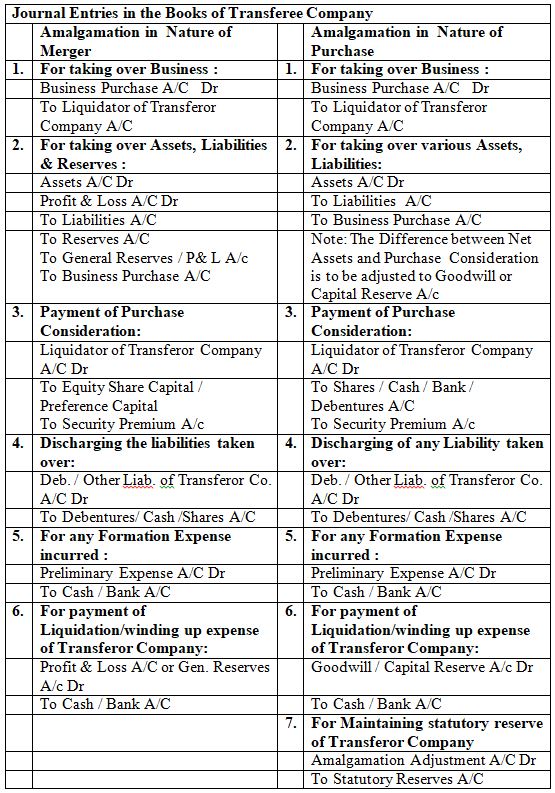

Methods of Accounting for Amalgamations :

According to AS 14 there are two methods of accounting for amalgamations :

1. Pooling of Interests Method :

This method issued in case of amalgamation in nature of merger. The accounting is done in the following manner.

a. The assets, liabilities, profit & loss account and reserves (whether capital, revenue or revaluation reserves) of the transferor company are recorded in the books of the transferee company at the same values and in the same form as at the date of amalgamation. This reflects the fact that the entries are simply merged together. No goodwill account should be accounted for.

b. If at the time of amalgamation, the transferor and transferee companies have conflicting accounting policies, a uniform set of accounting policies should be adopted following amalgamation.

c. The difference between the amounts recorded as share capital issued (plus any additional consideration in the form of cash or other assets) and the amount of share capital of Transferor Company should be adjusted against reserves of Transferee Company.

2. Purchase Method :

This method is used for amalgamation in nature of purchase. The application of method involves the following:

a) The assets and liabilities of the transferor company should be incorporated in the books of transferee company on the basis of their agreed values (i.e. either book values or the fair values).

b) The reserves (whether capital, revenue or revaluation reserves) of the transferor company other than the statutory reserves should not be included in the financial statements of the transferee company.

c) Any excess of the purchase consideration over the value of net assets of the transferor company should be treated as goodwill and debited to goodwill account. On the other hand if purchase consideration is lower than the value of net assets acquired, the difference should be credited to capital reserve. AS-14 recommends that goodwill arising on amalgamation should be amortized over a period of five years unless a somewhat longer period can be justified.

d) No reserves, other than statutory reserves, of the transferor company should be incorporated in the financial statements of the Transferee Company. Statutory reserves of the transferor company should be incorporated in the balance sheet of the transferee company by way of the following journal entry.

Amalgamation Adjustment A/c Dr.

To Statutory Reserves A/c

When the above statutory reserves will no longer be required to be maintained by transferee company, such reserves will be eliminated by reversing the above entry.

Journal Entries in the Books of Transferor Company:

1 Assets Transfer :

Realisation A/C Dr

To Assets A/C

2. Transfer of Liabilities taken over by transferee company :

Liabilities A/C Dr

To Realisation A/c

3. Transfer preference share capital to preference share holder :

Preference share capital A/C Dr

To preference share holder A/C

4. Transfer of Equity Capital & Reserves :

Equity Share Capital A/C Dr

Reserves & Surplus A/C Dr

To Equity Share holder A/C

5. Transfer of Accumulated Losses or Fictitious Assets :

Equity Shareholders A/C Dr

To Accumulated Loss/Ficti. Assets A/C

6. For Purchase Consideration Due :

Transferee Company A/c Dr

To Realisation A/C

7. For Purchase Consideration received :

Cash / Bank A/C Dr

Equity Shares / Preference Shares / Deb. In Transferee Co A/C Dr

To Transferee Co A/C

8. For Disposing assets not taken over by Transferee Co :

Cash / Bank A/C Dr

To Realisation A/C

9. For payment of liabilities not taken over by Transferee company :

Liabilities A/c Dr

To Cash / Bank A/C

10. For liquidation expenses :

a. Paid by Transferor Company

Realisation A/C Dr

To Cash / Bank A/C

b. Paid by Transferee Company

No Entry

c. Paid first by Transferor and later recovered

Transferee Co A/C Dr.

To Cash A/C

Cash A/C Dr.

To Transferee Co A/C

11. Payment of Preference shareholders :

Preference share holder A/C Dr

To Equity/Pref Sh. in Transferee Co/ Cash /Bank A/C

12. To close Realisation Accounts :

a. In Case of Profit :

Realisation A/C Dr

To Equity share holder A/C

b. In Case of Loss :

Equity share holder A/C Dr

To Realisation A/C

13. Close Equity Share Holder Accounts :

Equity shareholders A/C Dr

To Equity share / Preference Share / Cash / Bank A/C

No comments:

Post a Comment